Hurt in a Car Accident or

Motorcycle Crash? Lost a Loved

One in a Wrongful Death?

Social Security Disability Lawyer

SSDI vs SSI

Social Security Disability Insurance (SSDI) is based on work credits you earned by paying into the Social Security trust fund through your taxes. The SSDI will then act as insurance for workers who have earned sufficient credits based on taxable work. There is, however, something worth noting: paying into the Social Security trust does not automatically earn you the right for those benefits; you need to have reached the minimum credits required to be able to apply for such benefits.

Supplemental Security Income (SSI) provides support based on income level, age, and disability, while SSDI focuses on work history. So, in simpler terms:

- SSI = Age 65 or above OR Disability + limited resources or income (or none at all)

- SSDI = Disability + sufficient work credits

You will qualify for Medicare 24 months after you become entitled to receive benefits.

It is also worth noting that you can apply for both SSI and SSDI benefits if you have limited income AND a work history.

Determining Your Eligibility for Social Security Disability Benefits

Navigating the Social Security Disability (SSD) benefits process can seem daunting, but understanding the criteria can help clarify whether you might qualify for assistance. The Social Security Administration (SSA) uses a structured five-step evaluation to assess eligibility.

Step 1: Current Employment Status

To start, are you employed right now? If you’re earning over $1,550 per month (as per 2024 guidelines), the SSA considers this “substantial gainful activity,” meaning you likely don’t qualify as disabled. If your earnings fall below this threshold or you’re not working, you move to the next step.

Step 2: Severity of Your Impairment

Next, evaluate whether your condition significantly limits basic work activities. These activities include standing, sitting, lifting, and remembering simple tasks. If your impairment drastically interferes with these functions, the assessment progresses to step three.

Step 3: Inclusion in the SSA’s Blue Book

The SSA publishes the “Blue Book,” a comprehensive guide detailing medical conditions and their specific criteria. If your condition matches or is as severe as the one listed, you may qualify as disabled. Lacking a direct match requires moving to step four.

Step 4: Ability to Perform Past Work

Consider your prior employment. Can you meet the physical and mental demands of your previous jobs despite your limitations? If you can, qualification for benefits may not be possible. However, if your condition prevents returning to past work, proceed to the final step.

Step 5: Capability for Other Work

Lastly, the SSA examines if you can adjust to different employment, considering your age, education, work history, and any transferable skills. If your abilities do not match any suitable jobs, you will be considered disabled and can qualify for SSD benefits.

By understanding and preparing for each of these steps, you can better navigate the process of determining your eligibility for Social Security Disability benefits.

Duration of SSDI benefits

It is also worth noting that for Social Security Disability payments have no termination IF you suffer from severe and permanent disabilities, in that case you will continue to receive such payments until your retirement, when at that point these benefits will become retirement payments until your death.

For this to be determined, if you are awarded with the benefits then your case will be categorized into one of these categories: [1]

- Medical Improvement Expected (MIE). This means the SSA expects your condition to improve, so they will schedule a continuing disability review (CDR) in approximately six to eighteen months. If the condition has improved and you are able to return to work, your benefits will be discontinued; if it hasn’t improved, the SSA will continue to schedule a review until you are able to work again.

- Medical Improvement Possible (MIP). This means the SSA believes your condition may improve expects, but does not has certainty. The CDR will take place at least once every three years and will continue until you are able to work again if that is the case.

- Medical Improvement Not Expected (MINE). This means the SSA does not expect your condition to improve; in some cases, it can even worsen with time. This is why the CDRs are scheduled with less frequency, ranging between 5 and 7 years between each one.

What is “Disability” and Other Criteria

Now, when talking about “disability”, we need to understand what the Social Security Administration (SSA) defines as one. More than a definition, the guidelines of the SSA give a criterion the applicant needs to meet in order to apply for SSD benefits, these being:

- You cannot perform your previous occupation. (Meaning you cannot assist to work, or need to take breaks more than often, interfering with you performing your duties at work)

- You cannot adjust to other work because of your medical condition(s).

- Your medical condition(s) must last or be expected to last for at least one year and/or to result in death.

In addition to the criterion, the SSA usually complements it with a medical guide called the Blue Book to determine if the applicant is eligible for SSD benefits. This Book has sections for different body parts and systems (respiratory, circulatory, etc.) and lists for disabling conditions that may apply to that specific part of the body. This is why you will need to provide hard medical evidence to support your claim and to show that you meet the criteria of the listing.

Also, you need to fall under the criteria of Substantial Gainful Activity (SGA), meaning that there will be a study to determine if you have a minimum monthly earning of $1,310 USD or $2,190 USD for statutory blind persons.[2]

Understanding the SSA’s 5-Step Disability Determination Process

The Social Security Administration (SSA) employs a detailed 5-step evaluation process to determine if an individual qualifies for disability benefits. Here’s how it works:

1. Assessing Current Employment Status

The initial step examines whether you are currently employed. If you’re working and earning over a specific monthly amount, known as “substantial gainful activity” (for 2024, this threshold is $1,550), you may not qualify as disabled. If your earnings are below this level or you’re not working, the process moves forward to the next step.

2. Evaluating the Severity of Impairment

Next, the SSA checks if your medical condition significantly limits your ability to perform basic work activities. These activities might include sitting, standing, walking, or remembering instructions. If your impairment interferes substantially, the SSA proceeds to the third step.

3. Checking the SSA’s Impairment Listing

At this stage, your condition is compared against the SSA’s Listing of Impairments, often called the “Blue Book.” This list outlines specific medical criteria for various conditions. If your condition matches or is equal in severity to a listed impairment, you’re considered disabled. If not, the evaluation continues.

4. Analyzing Ability to Perform Past Work

The fourth phase investigates whether your impairment prevents you from doing work you’ve previously done. If your current abilities align with the demands of your past relevant work, you may not be deemed disabled. However, if your condition stops you from returning to those roles, the assessment proceeds.

5. Determining Capability for Other Work

Finally, the SSA considers whether you can adapt to other types of work, accounting for your age, education, work experience, and transferable skills. If it’s determined that you cannot perform any other job due to your limitations, the SSA will conclude that you are eligible for disability benefits.

This structured process helps ensure that all key factors are considered before making an eligibility decision for disability benefits.

Which Disabilities Were Awarded Benefits More Regularly?

According to the annual report of the SSA for 2019, published in October 2020, the most common disabilities from people who received benefits were:

- Musculoskeletal system and connective tissue (29.9%) (average monthly benefit $1,320.73 USD)

Examples of musculoskeletal system conditions:

- Amputation

- Anterior Poliomyelitis

- Apert syndrome

- Avascular Necrosis

- Back Pain

- Bone Spurs

- Bursitis

- Carpal Tunnel Syndrome

- Club Foot Deformity

- Cubital Tunnel Syndrome

- Degenerative Disc Disease

- Degenerative Joint Disease

- Dwarfism

- Fibromyalgia

- Fracture of the Femur, Tibia, or Pelvis

- Fracture of an Upper Extremity

- Gout

- Hernia

- Herniated Disc

- Hip Pain and Related Disorders

- Hip Replacement

- Inflammatory Arthritis

- Joint Pain

- Knee Pain and Related Disorders

- Knee Replacement

- Low Birth Weight

- Lumbar Stenosis

- Lyme Disease

- Major Dysfunction of a Joint

- Nerve Root Compression

- Muscular Dystrophy

- Neck Pain and Neck Problems

- Osteoarthritis

- Osteomalacia

- Osteoporosis

- Paralysis

- Piriformis Syndrome

- Reflex Sympathetic Disorder

- Rheumatoid Arthritis

- Ruptured Disc

- Scoliosis

- Shoulder Pain and Shoulder Problems

- Shoulder Replacement

- Soft Tissue Injury (Burns)

- Spina Bifida

- Spinal Arachnoiditis

- Spinal Cord Injury

- Spinal Fusion

- Spine Disorders

- Torn ACL

- Undifferentiated and Mixed Connective Tissue Disease

- Whiplash

- Mental disorders, but more specifically:

- Mood disorders (12.6%) (average monthly benefit $1,118.33 USD)

- Intellectual disability (8.7%) (average monthly benefit $795.81 USD)

Example of Mental disorders:

- Attention Deficit Hyperactivity Disorder

- Asperger’s Syndrome

- Bipolar Disorder

- Chronic Insomnia

- Depression

- Drug Addiction

- Dysthymia

- Eating Disorders

- Hallucinations

- Intellectual Disability

- Memory Loss

- Mood Disorder

- Obsessive Compulsive Disorder

- Panic Attacks

- Postpartum Depression

- Post Traumatic Stress Disorder

- Schizoaffective Disorder

- Social Anxiety

- Nervous system and sense organs (9.8%) (average monthly benefit $1,243.73 USD)

- Circulatory system (7%) (average monthly benefit $1,368.91 USD)

Examples of circulatory system conditions:

- Arrythmia

- Blood Clots

- Budd-Chiari Syndrome

- Chest Pain

- Chronic Pulmonary Hypertension

- Cor Pulmonale Secondary Chronic Pulmonary Hypertension

- Heart Attack

- Heart Failure

- Heart Valve Disorder

- High Blood Pressure

- High Cholesterol

- Hypertension

- Left Ventricular Assist Device

- Marfan Syndrome

- Mitral Valve Prolapse

- Sinus Bradycardia

- Syncope/Fainting

- Venous Insufficiency

Initial Claim: Process and Documentation

When filing the initial application and filling the SSD benefits forms, you need to provide to the most of your capacity and availability in the following documents:

- a comprehensive list of your medical providers, including their contact details and dates of treatment service

- copies of your medical records, including exam notes, surgical notes, test results, imaging records

- Copies of anything else that proves your medical condition, as well as its restrictions and limitations

It is worth noting, however, that if you are suffering from a single or multiple medical conditions and develop another impairment along the way, the amount of your monthly benefit payment remains the same.

In other words, your benefits do not increase based on the development of an additional impairment. That being said, you should always keep the SSA informed of any changes in your medical condition.

While the application process varies depending on the severity of the disease, the thoroughness of the application, and the geographical area where the applicant lives, the national average for processing the initial application is 3 to 5 months if the medical providers are quick to respond and if any additional information required by the Social Security Administration (SSA) is promptly received.

In Florida, an average of 70% of initial claims are denied[3]. Of these 70% denied claims, less than 10% are awarded during the reconsideration process[4].

If the claim needs additional analysis, the SSA requests that the applicant meet with a disability doctor, usually the original doctor who determined the condition, to get more insight into the severity of a specific medical condition, unless there are location difficulties to visit the original doctor or that there are inconsistencies in the original report that disqualifies said doctor. If this happens to be the case, then an independent examiner will be appointed.

Once the Disability Determination Services (DDS) determines it has sufficient medical information, it will proceed to decide whether you can be awarded the benefits.

What Happens If I Am Denied of the Benefits in My Initial Claim?

When the DDS denies a disability claim, it can fall under two considerations:

- Technical refusal – You did not pay enough taxes to the SSA for coverage. (this can be confusing since it means that not because you have paid taxes into the disability program, it necessarily translates into you having the coverage. You need to pay a certain amount into the program for coverage to begin)

- Medical refusal – You did not meet the definition of disability.

Appeals Process: Options After an Initial Denial

If your initial claim is denied, you have 60 days to file for reconsideration, where a different examiner will review your case under the same criteria unless new medical information is provided. The success rate for reconsiderations is low, often under 10% in Florida, and typically takes 3 to 5 months.

If reconsideration is denied, you can request an appeal hearing before an Administrative Law Judge. Nationwide, the wait for a hearing date can be lengthy—averaging 10 months to 2 years, with around 60% of appeals in Florida resulting in benefits approval. If denied again, you can request a review by the Appeals Council or, as a final option, file a civil action in Federal Court.

In Florida, approximately 60% of disability benefits are granted at the appeals hearing.

If you, however, fall under the 40% that is denied at the appeals hearing, your next option would be to request that the Appeals Council review the judge’s decision (Appeals Council Review), having 60 days from the day of denial to file such request.

If you are then denied again, your final option will be filing a civil action in Federal Court.

How Much Will I Be Awarded?

If benefits are granted, the amount will be calculated according to a formula based on the income on which you have paid Social Security taxes. The monthly maximum Federal amounts for SSI in 2021 are $794 for an eligible individual, $1,191 for an eligible individual with an eligible spouse, and $397 for an essential person.[5] For SSDI, you can obtain an estimate by using the SSA’s Benefit Calculators.

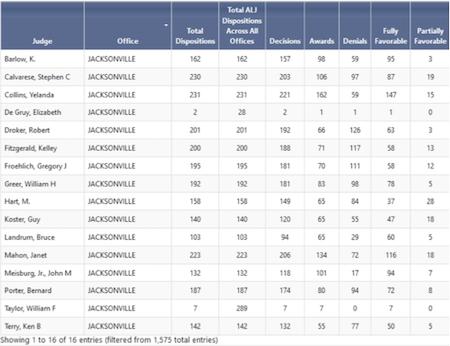

Jacksonville, Florida SSDI Denial Lawyer

As of March 2021, Jacksonville’s “average wait time until the hearing is held” is 8 months, with an average process time of 315 days (days until the final deposition).

Currently, there are 16 hearing offices in Jacksonville.

For Jacksonville, out of the 16 judges in the city, at least 8 judges granted more than 50% of the hearings:

- Taylor, William F: 100% out of the decisions made

- Meisburg, Jr., John M: 85.59% out of the decisions made

- Collins, Yelanda: 73.30% out of the decisions made

- Landrum, Bruce: 69.15% out of the decisions made

- Mahon, Janet: 65.05% out of the decisions made

- Barlow, K.: 62.42% out of the decisions made

- Calvarese, Stephen C: 52.22% out of the decisions made

- Koster, Guy: 52.17% out of the decisions made

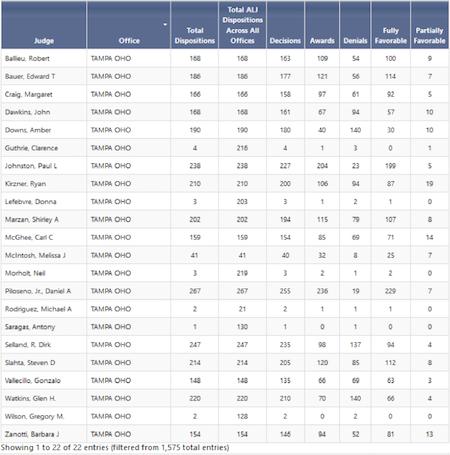

Tampa, Florida SSDI Denial Lawyer

As of March 2021, Tampa’s “average wait time until the hearing is held” is 7 months, with an average process time of 291 days (days until the final deposition).

Currently, there are 22 hearing offices in Tampa.

For Tampa, out of the 22 judges in the city, at least 12 judges granted more than 50% of the hearings:

- Piloseno, Jr., Daniel A 92.55% out of the decisions made

- Johnston, Paul L: 89.87% out of the decisions made

- McIntosh, Melissa J: 80% out of the decisions made

- Bauer, Edward T: 68.36% out of the decisions made

- Ballieu, Robert: 66.87% out of the decisions made

- Zanotti, Barbara J 64.38% out of the decisions made

- Craig, Margaret: 61.39% out of the decisions made

- Marzan, Shirley A: 59.28% out of the decisions made

- Slahta, Steven D 58.54% out of the decisions made

- McGhee, Carl C: 55.19% out of the decisions made

- Kirzner, Ryan: 53% out of the decisions made

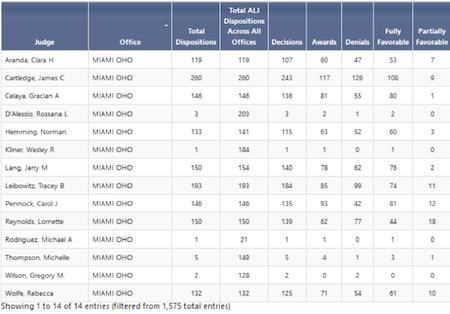

Miami, Florida SSDI Denial Lawyer

As of March 2021, Miami’s “average wait time until the hearing is held” is 9 months, with an average process time of 312 days (days until the final deposition).

Currently, there are 14 hearing offices in Miami.

For Miami, out of the 14 judges in the city, at least 7 judges granted more than 50% of the hearings:

- Thompson, Michelle: 80% out of the decisions made

- Pennock, Carol J: 68.89% out of the decisions made

- Celaya, Gracian A: 59.55% out of the decisions made

- Wolfe, Rebecca: 56.80% out of the decisions made

- Aranda, Clara H: 56.07% out of the decisions made

- Lang, Jerry M: 55.71% out of the decisions made

- Hemming, Norman: 54.78% out of the decisions made

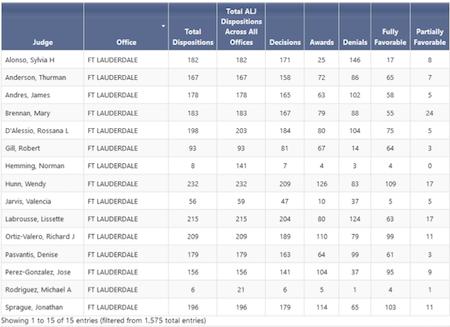

Fort Lauderdale, Florida SSDI Lawyer

As of March 2021, Fort Lauderdale’s “average wait time until the hearing is held” is 6 months, with an average process time of 265 days (days until the final deposition).

Currently, there are 15 hearing offices in Fort Lauderdale.

For Fort Lauderdale, out of the 15 judges in the city, at least 7 judges granted more than 50% of the hearings:

- Rodriguez, Michael A: 83.33% out of the decisions made

- Gill, Robert: 82.72% out of the decisions made

- Perez-Gonzalez, Jose: 73.76% out of the decisions made

- Sprague, Jonathan: 63.69% out of the decisions made

- Hunn, Wendy: 60.29% out of the decisions made

- Ortiz-Valero, Richard J: 58.20% out of the decisions made

- Hemming, Norman: 57.14% out of the decisions made

Benefits of Hiring a Specialized Attorney Social Security Disability Lawyer in Florida

One advantage of hiring a region-familiar attorney is that the attorney might have become familiar with the judges of the region. While you may opt to hire the services of an advocate, we strongly suggest hiring an attorney specialized in SSD benefits claims since the training and educational background might differ significantly.

In addition, and as noted earlier, the whole process can be confusing, strict, punctual, and, because of this, complicated. An attorney who practices Social Security disability law is essential because they understand the process and are familiar with the deadlines for each phase.

One of the first complications you might encounter when filing for SSD benefits is not providing the full and/or correct information required. That is why the attorney will help you compile all the medical documentation needed and oversee that doctors answer all questions accurately and completely.

What Would be My Attorney Fee, and How Many Payments Do I Have to Make?

Attorneys are never paid unless you win. The fees are limited to 25% of the accrued benefit amount, and they cannot exceed the amount of $6,000. This payment will be made only after the benefits are conceding (a favorable determination for the applicant). And it also guarantees that there are no out-of-pocket expenses.

[1] Program Operations Manual System (POMS)

[2] Substantial Gainful Activity

[3] Florida Social Security Disability Lawyers